As the debate over vacation rentals in Hawaii continues to rage, we came upon interesting data confirming it’s not only the state and the hotel industry that are less inclined towards Hawaii vacation rentals. It’s visitors as well. This comes as the landscape of Hawaii accommodation options is on the brink of big change. Recent legislative proposals and statements from Hawaii’s governor reflect an effort to address the proliferation of short-term rentals, particularly those owned by non-residents.

In last month’s State of the State Address, Hawaii’s governor underscored an urgency for transitioning short-term rentals into the local housing market. Citing data that showed a significant portion of such rentals are owned by non-residents, Governor Green emphasized the need to prioritize local families’ access to housing over lucrative short-term rental profits. This sentiment reflects the perceived impact of short-term rentals on Hawaii’s housing affordability and availability. The state’s research arm, however, isn’t exactly of the same opinion.

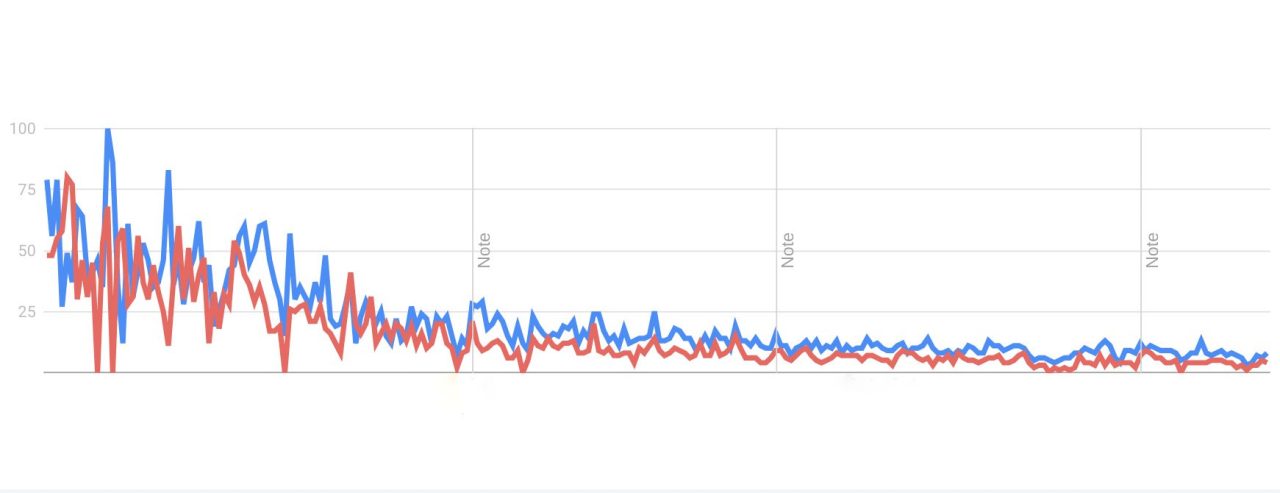

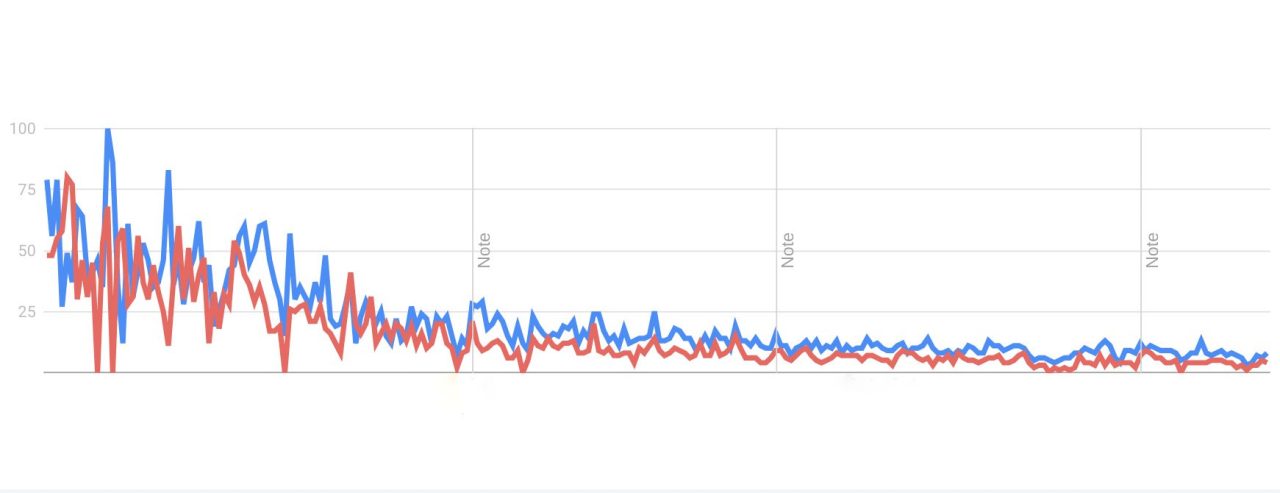

Hawaii vacation rental interest by visitors has been in decline for years.

The above graph reflects visitors interest in Maui vacation rentals (blue) and Kauai vacation rentals (red). That is based on historical Google search data over the past twenty years.

Hawaii vacation rental performance has been under-performing, reflecting a complex scenario. In 2023, Hawaii reported a decline in both demand and occupancy.

For those visitors considering these accommodations rather than Hawaii hotels, increased vacation rental pricing adds yet another complexity. While vacation rentals continue to offer benefits such as cost-sharing and kitchen-based savings, Hawaii visitors should be aware of unexpected costs (which you should also check for hotels), and potential inconsistent quality and service issues. Careful vetting of vacation rental accommodations is essential to ensure legality, affordability and value for travelers, especially considering the high degree of variability in fees and amenities offered.

How did Hawaii vacation rentals fare in 2023?

Last year, the Hawaii’s vacation rental market underwent notable shifts. The short-term rental supply reflected a 14.5% decline compared to pre-pandemic 2019. However, despite this relatively small decline in supply, demand for Hawaii vacation rentals experienced a more substantial decline of 35.5% compared with pre-Covid.

Another interesting aspect is that the average daily unit rate before taxes and fees went to $301 in 2023. That was a surge of 45.1% compared with pre-Covid. The ongoing increases in pricing are influenced by various factors including increased operating costs, lower occupancy, and other market dynamics.

In terms of the short-term rental occupancy rate for 2023, statewide it was at just 55.9%, which represented a considerable 24.6% decline compared with 2019.

Legislature seeks to eliminate Hawaii vacation rentals.

Hawaii’s Legislature is exploring various measures to further regulate vacation rentals. House Bill 84, introduced in the previous session and carried forward into 2024, aims to grant counties greater authority to begin phasing out short-term rentals.

HB84 “Makes explicit the counties’ authority to enact ordinances to amortize or phase out permitted, nonconforming, or otherwise allowed short-term rentals in any zoning classification. Includes swapping, bartering, or exchange of a residential dwelling, or portion thereof, in definition of “short-term rental” for this purpose.”

The Hawaii Hotel industry wants to curb vacation rentals for its benefit.

The Hawaii Lodging and Tourism Association (HLTA) has emerged as a strong advocate for stricter regulations on vacation rentals. Led by President Mufi Hannemann, HLTA represents a significant portion of Hawaii’s hotel industry and has long sought to limit competition posed by Hawaii vacation rentals. HLTA says its membership “includes 169 properties representing 50,000 rooms.” With Hannemann now also chairing the Hawaii Tourism Authority (HTA), there is concern among some that his influence may further tilt the scales in favor of hotel interests.

Visitor and resident sentiment on the Hawaii vacation rental issue vary widely.

Some express frustration at the perceived targeting of vacation rentals by policymakers and industry lobbyists. Concerns about rising hotel prices and the potential impact on local residents’ livelihoods are particularly prevalent among those who rely on small-scale vacation rental income to make ends meet. Others, however, point to the imposition of vacation rentals into otherwise residential communities and the negative impact on Hawaii’s long-term resident housing.

The state’s research arm, UHERO, says that about 5% of Hawaii’s total housing is short-term rentals, although it varies greatly by island. It also concludes that short-term vacation rentals on Oahu, for example, may result in an increase in overall housing cost by 5%.

As the debate over vacation rentals in Hawaii continues, the future of short-term accommodations remains uncertain. As efforts to address housing affordability and regulate tourism continue, policymakers are faced with complex legal, economic and social dynamics.

Please let us know where you stand on Hawaii’s intentions for vacation rentals.

december-2023-hawaii-vacation-rental-performance-final

Why would the legislature almost unanimously vote to turn full control of STVRs over to the Mayors? The legislators & Governor know what the mayors want to do. They can see the extremely negative financial implications on the whole state of the Mayors’ goals since there is little revenue generated now besides the Military and tourism. Makes no sense except for one reason.

I can only speak for our property, south of Hilo. In 2016-7 We built, landscaped and furnished a 3-bed 2-bath 1400 ft2 home with a 40X12 lap pool on 1 acre for just under $500,000. We began renting it as STVR in 2018. Our goal was to break even, with rental ncome. We average about 200 rental days annually, and we we visit for maintenance and our own use twice a year. We have nearly all 5-star reviews. I surveyed our guests asking how many would have considered Hawaii for a vacation if they could only stay in a hotel or resort. 100% responded ‘No’. We do not serve the same market. We have not made local housing inventory more expensive. We have put 10s of thousands of dollars annually into the local economy and the tax coffers.

So much talk about money going out to off island owners when Ten times more money than STRs is going out to massive off island hotel corporations. These same corporations are the ones trying to push out the little guys STRs who are offering less expensive accommodations. More expensive accommodations at hotels means less money spent on the local economy

There are so many unlicensed illegal STRs. Close those and problem solved. Don’t change the rules and go after those whole followed the rules

Totally agree! Why punish law/ policy abiding citizens?

I prefer to use a short term rental over a hotel for longer stays for many reasons. I find it interesting that one of the main reasons to push hotels over STR is ownership is likely out state residents. However how many hotels are owned by local residents or companies. Most are owned bt out of state and country cooperations are they not.

Unfortunately this change will further decrease visitors, people who can afford will purchase their own place.

There should be a middle ground in here .

Touché

Having only big hotels that take money out of Hawai’i is not a good answer. The small amount of vacation rentals support the community and allow for families to travel. We need the government to support Hawaii, instead of taking the money to big business and out of the state.

Why not shut down just one or two municipal golf courses and and build hundreds of affordable homes? The tax base should remain the same. Oh, wait, that would be shutting down instead of personal resources.

I believe this is unconstitutional that the government tries to tell the people what they can and cannot do with their property.

Ty to open a brothel or a bar in your home. See how it goes.

Seems to me these efforts to limit or eliminate short term rentals are just another step in reducing attractiveness of Hawaii for visitors.

Of course the hotel industry wants the short term rentals out, less competition for them. Everyone has a right to compete! The majority of short term rentals are condos and are perfect for short term rentals. There is No way a homeless person could afford a nice condo, lol! Let people try to make a decent living -let them rent!!

Tourism is already down. Like it or not this is a money maker for Hawaii and for locals and all who live here and depend upon the tourists to survive. Not thrive; just survive. Then you consider taking away the only reasonable accommodations in the form of stvrs, airbnbs and take away our right to choose with only hotels / motels as our only options? This is a dagger to the heart for all of Hawaii if this becomes a reality.

Over the years all the owners whose apartments I have rented depend on the income. And with no hotels on the Windward coast there is no alternative. Does the governor really think these owners whose apartments are part of their home are really going to rent to the homeless? Those who are homeless couldn’t afford to rent these apartments. I spent my entire career helping people like HI’s homeless and empathize with them but this isn’t the solution.

Yet somehow the economy survived for decades before the introduction of Airbnb STRs etc. How in the world did they do it.

The economy survived by the presence of vacation rental companies, which have been renting out thousands of short-term rentals since the 1950s. Airbnb, etc. just makes it easier to reach a larger audience, and for owners to rent out their vacation homes themselves, as long as they have an on-island manager.

Short-term rentals have been a massive part of the Hawaiian economy and tax revenues for 70 years.

It appears the Hawaiin Govener, wants to pick on the little people.

Short term rental only equal 5%.

How about this governing party of Hawaii look at this.

The celebrities who own thousands of acres and visit rarely not be allowed to own so much acreage.

Oprah for example owns 870 acres. That is pure greed. That would leave 860 acres for housing for Hawaiin residents.

That is whole heck of a lot of houses for families.

At quarter acre each for a house that is 3,440 houses that could be built.

And that is just one example on one celebrity that grossly owns land in Hawaii.

Leave the measly 5%

people alone that have short term housing rentals.

Getting land on which to build is not the problem.

Getting approvals and the government’s refusal to subsidize the building of affordable housing is the problem.

Mayor Bissen and Governor Green just announced last week for those Lahaina and Kula residents who have land that has been cleared and utilities re-established, there will be an expedited approval process, bypassing the layers you mentioned. For those unable to build right away, Maui is constructing a Kau Hale type series of structures with utilities for temporary use. When life eventually returns to somewhat normal, these Olowalu-located structures will be Kau Hale (homeless) for the west side.

—

Write this to the governor and your state legislators!

Speaking in hypotheticals. If Oprah were to allow the building of 3440 houses on her property… who is to stop those houses being sold to out of state investors who in turn convert them to STR’s? Hmmmm. Could it be regulations?

You would conclude that the state laws that are being proposed are about curbing “Short Term Rentals”. The authors do this, because they know that using the dreaded word ‘STR’ riles up the locals.

The proposal to change the county’s authority is Not about STRs, it is about making 30+ day rentals that have been legal for decades, illegal. The county of Honolulu wants to make residential units only available for rent for greater than 180 days. STRs are defined for the State of Hawaii as rentals for less than 30 days.

Another point: if the rental rate for 30+ day rentals has fallen, then one wonders if non-vacation long term rentals have magically increased? Has it worked to increase rentals?

I had decided I would not be able to buy a condo and retire on the beach in Maui, but if Governor Green keeps at it, the bottom will drop out of the condo market enough for me to afford a really nice oceanfront unit. The question then would be, “how long is this going to stay really nice when it isn’t supported by short-term rental income?” The hotels might want to think about that as well before they destroy the condo rental market. Who is going to pay $1000/night at the Westin when there are run down residential towers on both sides of it?

I have commented on this before. I’m a 77 year-old woman with multiple disabilities. I have 2 young grandchildren living on Oahu in Kailua 1 is age 4 the other is age 7. I am currently in a rental in Kailua at the cost of a 30 day stay. Given the cost of this trip to see my grandchildren, over $10,000 I doubt I will ever in my lifetime be able to return to see them. Hawaii as a state, Honolulu, as a city & county, & the city of Kailua continue to restrict short term rentals.I am angry and frustrated and wonder if I will ever see these children again! Legislators should take this into consideration! I am sure I am not alone in this position